Swiss Venture Capital Achieves 24% Growth as Early-Stage Investment Hits Record $1.35 Billion

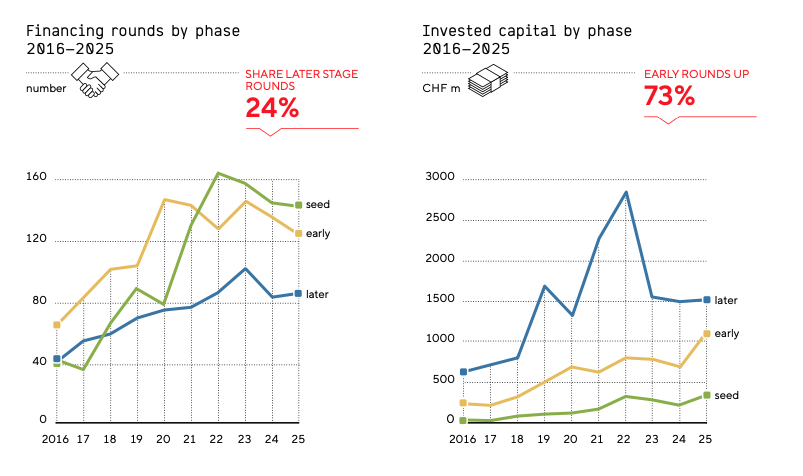

Switzerland’s venture capital market has delivered a powerful signal to international investors and ecosystem actors. While major European markets experienced flat or declining growth in 2025, Swiss startups attracted $3.56 billion in venture capital, marking a 23.9% increase over 2024. The most significant development: early-stage investment surged 73% to reach a record $1.35 billion, the largest jump in series A funding since 2018. This combination of overall growth, stable deal flow, and record early-stage activity positions Switzerland as Europe’s most resilient innovation ecosystem, as detailed in the newly published 2026 Swiss Venture Capital Report.

All figures have been converted from Swiss Francs (CHF) to US Dollars (USD) using the 2025 average exchange rate of 1 CHF = 1.207 USD.

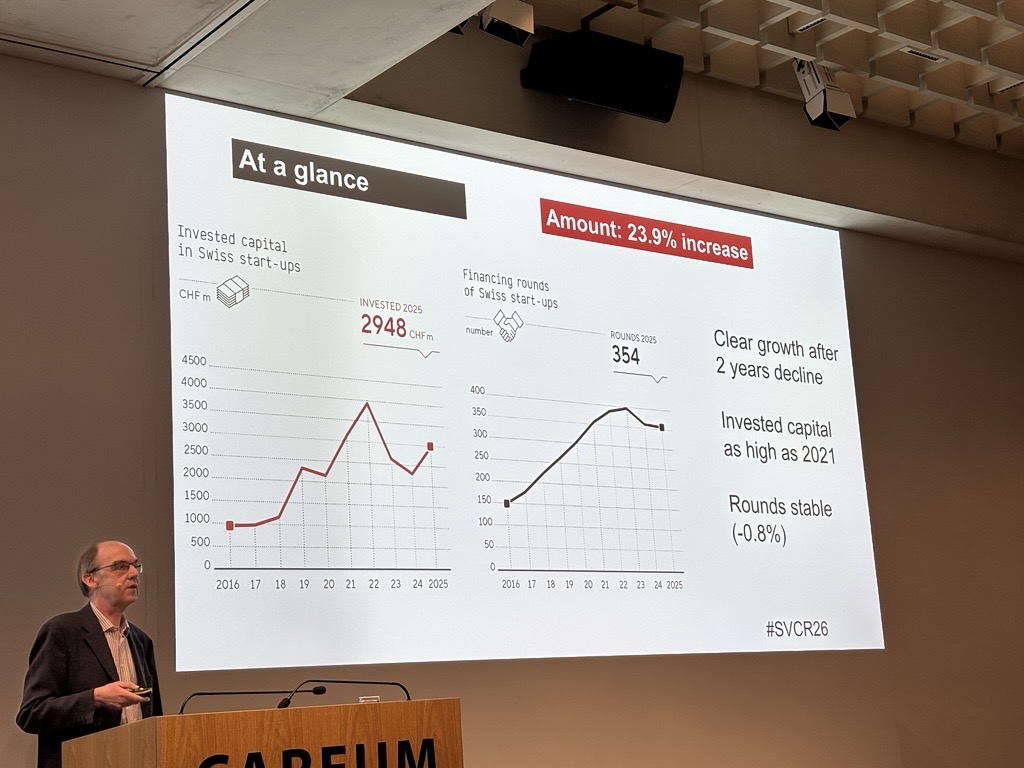

The Findings at a Glance

| Metric | 2025 Result |

|---|---|

| Total Investment | $3.56 billion (+23.9% vs 2024), outpacing European averages |

| Early-Stage Rounds | $1.35 billion (+73%), a new record signaling restored risk appetite |

| Financing Rounds | 354 rounds (−0.8%), maintaining high volume while European deal counts declined significantly |

| Biotech Investment | $1142 million, a new record after three consecutive years of growth |

| Large Rounds (>CHF 20M) | 32 rounds (record high), demonstrating Switzerland’s growing scaling capability |

Early-Stage Investment Defies Expectations

The $1.35 billion invested in series A rounds represents the most striking development in Switzerland’s 2025 venture capital landscape. This 73% increase from $781 million in 2024 marks the most significant jump in early-stage funding since 2018 and establishes a new record for the Swiss ecosystem.

The achievement proves particularly noteworthy given the uncertain macroeconomic environment. Conventional wisdom suggested that investors would favor less risky, more mature companies during periods of geopolitical and economic volatility. Instead, early-stage investment not only recovered but accelerated dramatically. Seven of the 20 largest financing rounds in 2025 went to early-stage companies, compared to just two in 2024.

As the report’s editors note in their analysis, the record proves surprising: “One might expect money to flow into less risky, more mature companies given the uncertain political and economic environment. But despite this environment, risk appetite is back.”

This record signals two critical developments for international observers. First, investor risk appetite has returned to the Swiss market. Second, Switzerland’s startup pipeline continues to produce companies worthy of substantial early-stage investment in sought-after technology sectors. The combination suggests sustainable momentum rather than temporary rebound.

Seed funding also grew substantially, rising 23.8% to $360 million, the second-highest figure on record. Together, these early-stage metrics provide a leading indicator for 2026 and beyond; today’s series A companies become tomorrow’s growth-stage investments and exits.

Switzerland Outpaces Major European Markets

Switzerland’s 23.9% venture capital growth in 2025 stands in sharp relief against the broader European landscape. According to PitchBook’s year-end analysis, European VC investment reached approximately €66 billion ($78 billion) in 2025, representing just 6.5% growth over 2024. Switzerland’s growth rate was nearly four times higher than the continental average.

The contrast becomes even more pronounced when examining deal activity. While Switzerland maintained 354 financing rounds with only a 0.8% decline, Europe experienced its fourth consecutive year of declining round counts. KPMG’s Q4 2025 Venture Pulse report noted that European deal volume “declined for the third consecutive quarter” in late 2025, with Q4 totaling just 1,651 deals despite $20.7 billion in investment, “reinforcing the trend of cautious capital deployment.”

Switzerland’s biotech sector performance particularly distinguished the ecosystem. As PitchBook observed, while “the smaller markets in the German-speaking DACH region, Austria and Switzerland, experienced sharper declines in VC funding” overall, “Switzerland’s biotech market posted a record year for deal value, driven by larger deals” including GlycoEra’s $130 million series B.

This biotech strength proved decisive. Switzerland’s $1142 million biotech record represented genuine sectoral momentum, while the broader DACH region struggled. The 354 financing rounds across all sectors, declining by less than 1%, contrasted sharply with Europe’s continued multi-year downward trend in deal counts.

The data reveals Switzerland as an outlier within Europe: strong double-digit growth, stable deal flow, and sectoral records in biotech, all while peer markets either stagnated or experienced modest single-digit gains amid declining transaction volumes.

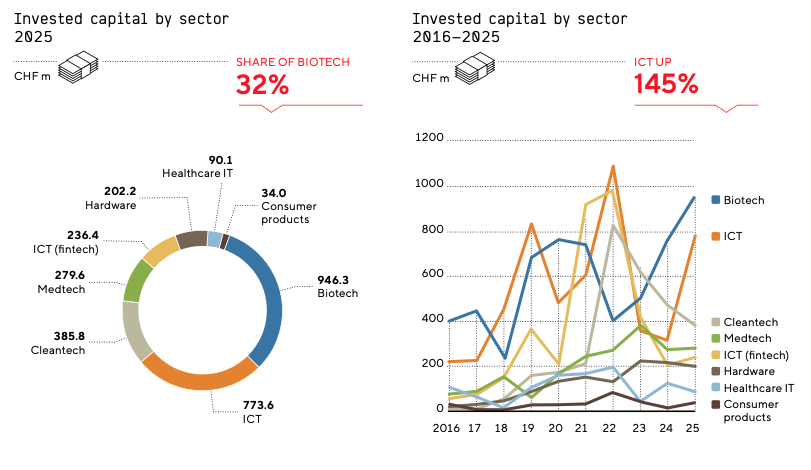

AI and Biotech Drive High-Risk Investment

The record early-stage investment flows predominantly into two technology sectors that have captured international investor attention: artificial intelligence and biotechnology. These sectors demonstrate Switzerland’s ability to produce startups in the most competitive and capital-intensive domains of deep tech innovation.

AI-focused startups attracted several of 2025’s largest early-stage rounds. DeepJudge, which applies AI to legal practice workflows, raised $40 million in series A funding. Unique secured $13 million for its AI-powered asset management and banking efficiency platform. Two robotics companies leveraging AI for autonomous operation in uncontrolled environments, Flexion Robotics and Gravis Robotics, raised $49 million and $22 million respectively. Corintis, developing advanced cooling technology for AI chips, completed a $24 million series A round.

These companies exemplify Switzerland’s strength in applied AI rather than foundational models. Swiss startups focus on specific industrial applications, enterprise software, and physical systems that combine AI with deep domain expertise, addressing clear market needs with defensible technology.

The biotech sector achieved its third consecutive year of growth, reaching a new record of $1142 million, approximately 25% higher than the previous peak set in 2020. Major rounds included Windward Bio‘s $221 million for immunological disease therapies, GlycoEra‘s $130 million series B for autoimmune disease treatments, and Mosanna Therapeutics‘ $79 million series A for sleep apnea pharmaceutical solutions.

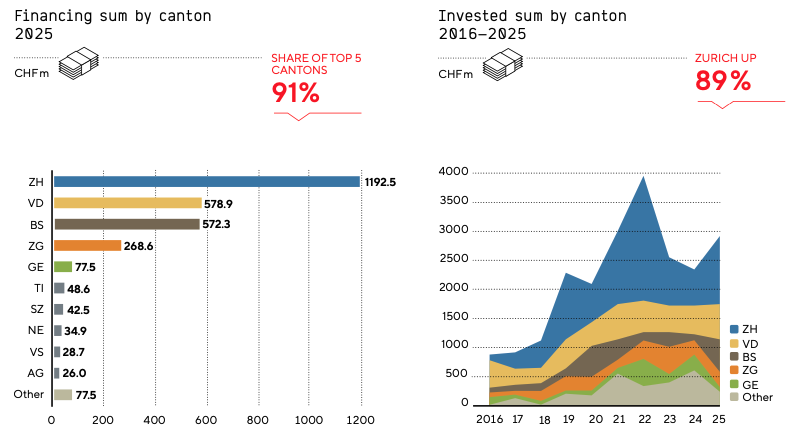

Basel-Stadt, Switzerland’s biotech cluster, directly benefited from this sectoral strength. The canton achieved a record $691 million in venture investment for 2025, with $659 million flowing to biotech companies. This represents 57.7% of all biotech investment across Switzerland, underlining Basel-Stadt’s position as the nation’s life sciences innovation center.

Scaling Capability Demonstrated with Record Large Rounds

Switzerland’s venture capital ecosystem increasingly supports companies as they scale. Thirty-two financing rounds exceeded $24 million in 2025, surpassing the previous record of 31 set in 2024 and significantly above the 10-year average of 21 large rounds per year.

Five transactions exceeded $121 million: Climeworks‘ $155 million for direct air capture technology, Distalmotion‘s $146 million for robotic surgery systems, GlycoEra’s $130 million, Auterion‘s $125 million for autonomous drone software, and Windward Bio’s $221 million.

The distribution of these large rounds across sectors (cleantech, medtech, biotech, and ICT) demonstrates breadth rather than concentration. Switzerland produces growth-stage companies across its core technology strengths rather than relying on a single hot sector.

Regional performance reflected this scaling capacity. Zurich startups attracted $1.44 billion, representing an 89.5% increase over 2024 and returning to levels first achieved in 2019. Vaud maintained strong performance at $699 million, the canton’s second-highest total on record. Combined with Basel-Stadt’s record year, the top three cantons accounted for approximately two-thirds of total Swiss venture investment.

Exit activity complemented this growth-stage momentum. Nine trade sales exceeded $121 million in valuation, establishing another record for the Swiss ecosystem. Notable exits included Araris Biotech to Taiho Pharmaceutical for over $1 billion, Nexthink to Vista Equity Partners at a $3 billion valuation, and Lakera AI to Check Point Software for $235.95 million.

Investor Confidence Points to Continued Growth

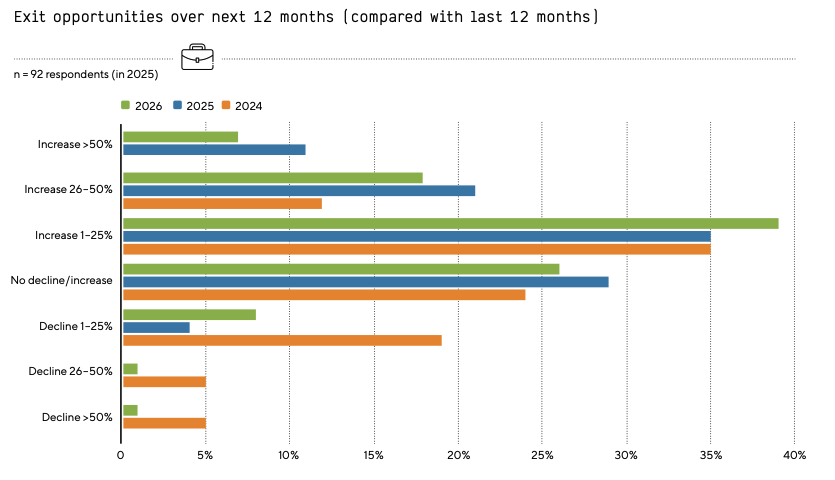

Swiss venture capital investors entered 2026 with increased momentum and optimistic outlook. Fifty funds remained active for investment as of early 2025, slightly higher than the previous year. More significantly, 66% of fund managers surveyed for the VC Barometer indicated plans to launch new funds in 2026, up from 40% in the prior year’s survey.

Investment intentions scaled upward substantially. Twenty-five percent of managers plan to invest between $62 million and $145 million over the next three years, more than double the proportion from the previous survey. The share of investors planning to invest up to $24 million fell from 51% to 41%, indicating a shift toward larger deployment strategies.

Market outlook remained constructive despite fundraising challenges. While 68% of respondents characterized the environment for raising capital as “unfavourable to difficult,” 74% expect Swiss investment volume to increase by at least 25% in 2026. Sixty-four percent anticipate increased exit activity, up from 44% in the previous year’s survey.

The improving exit environment particularly bolsters investor confidence. Beyond the nine exits exceeding $121 million in 2025, several high-profile transactions demonstrated international strategic interest in Swiss technology companies: duagon Group to Knorr-Bremse for €500 million, Yokoy to TravelPerk at a $2.7 billion combined valuation, and BioVersys‘ IPO on SIX Swiss Exchange with a $261 million market capitalization.

This combination of active fundraising, larger deployment targets, and exit momentum creates positive feedback loops. Successful exits return capital to limited partners, demonstrating venture returns and enabling subsequent fund commitments. This available capital supports continued investment into Swiss startups across all stages.

Switzerland’s Sustained Momentum

Switzerland’s 23.9% venture capital growth in 2025 represents more than recovery from the 2023-2024 correction period. The $1.35 billion early-stage investment record, achieved despite macroeconomic uncertainty, signals fundamental ecosystem strength across two critical dimensions: investor willingness to back high-risk companies and a startup pipeline producing compelling opportunities in competitive technology sectors.

The report’s editors emphasize the forward-looking implications: “The record in early-stage investments is particularly encouraging. It gives reason to believe that the amount of money invested will continue to grow in 2026.” This assessment reflects the fact that today’s series A companies become tomorrow’s growth-stage investments and exits, creating a visible pipeline for sustained momentum.

The contrast with peer European markets proves particularly instructive for international ecosystem actors. While the UK grew in the mid-to-high single digits and Germany experienced volatile quarterly swings, Switzerland sustained both capital growth and deal flow. The 354 financing rounds declined only marginally compared to significant decreases across Europe, demonstrating consistent startup formation and funding progression through all stages.

For international investors, corporates, and partners, Switzerland offers demonstrated resilience, sectoral strength in AI and biotech, and increasing capability to support companies as they scale. The early-stage record provides confidence in pipeline quality through 2026 and beyond; today’s series A investments mature into tomorrow’s growth rounds and exits. Combined with the nine exits exceeding $121 million and strong investor confidence heading into 2026, Switzerland continues to validate its position as Europe’s premier deep tech innovation ecosystem: compact, efficient, and consistently producing world-class technology companies.

Leave a Comment

Your email address will not be published. Required fields are marked *