20 Reforms to Compete Globally: The Swiss Startup Agenda by SSA

Switzerland’s startup ecosystem has reached a critical inflection point. While the country continues to lead Europe in per-capita spinout creation and deep tech innovation, structural barriers threaten its competitive position. Released in February 2026, the Swiss Startup Association’s “Startup-Agenda Schweiz” (in German) identifies 20 concrete policy reforms needed to transform Switzerland from an innovation laboratory into a scaling powerhouse that retains its best companies. The manifesto was developed with contributions from 18 ecosystem partners spanning investors, accelerators, and industry associations including Deep Tech Nation Switzerland and validated through a survey of 105 Swiss Startup Association members in October 2025.

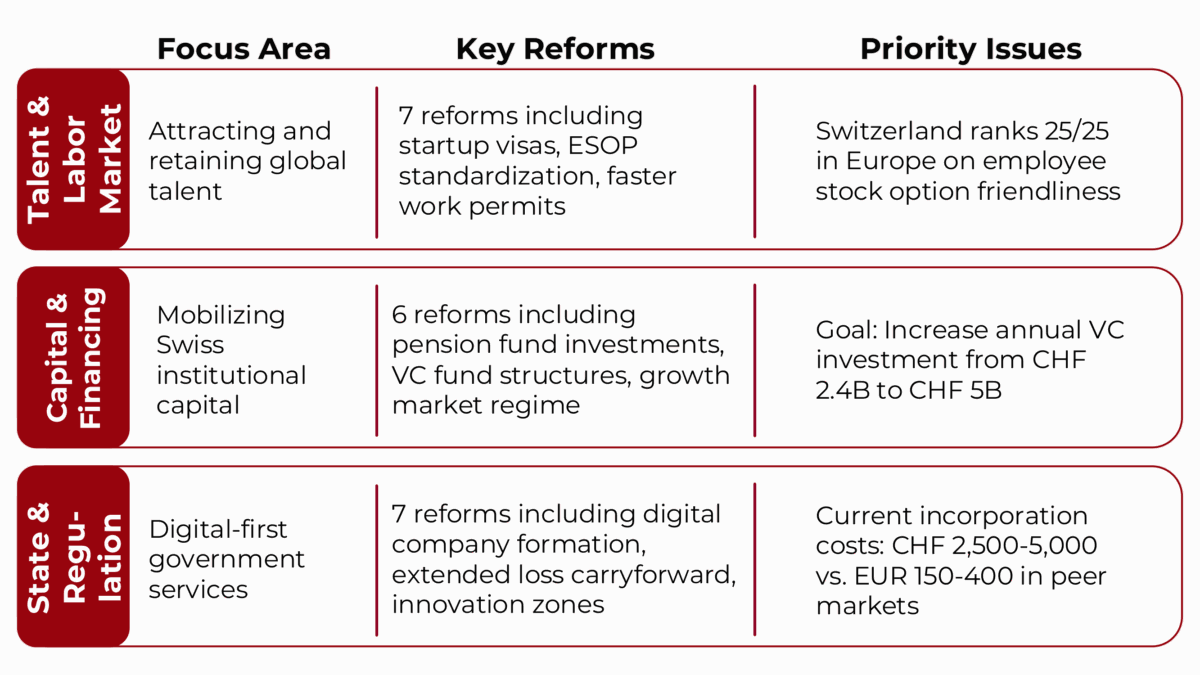

At a Glance: The Three-Pillar Reform Agenda

Why Switzerland Needs a Startup Reform Agenda Now

Switzerland’s innovation credentials remain world-class. ETH Zurich and EPFL rank among Europe’s top three universities for spinout value creation, and the country leads the continent in AI talent density at 4.8% of core AI professionals (Swiss Deep Tech Report 2025). Yet beneath these achievements, structural weaknesses threaten Switzerland’s competitive position in the global startup race.

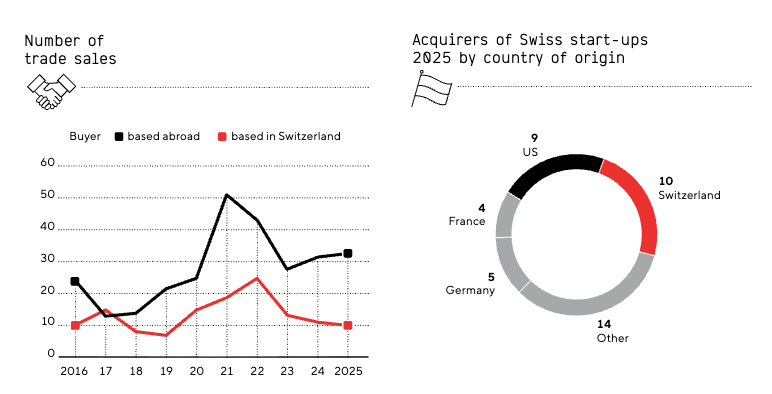

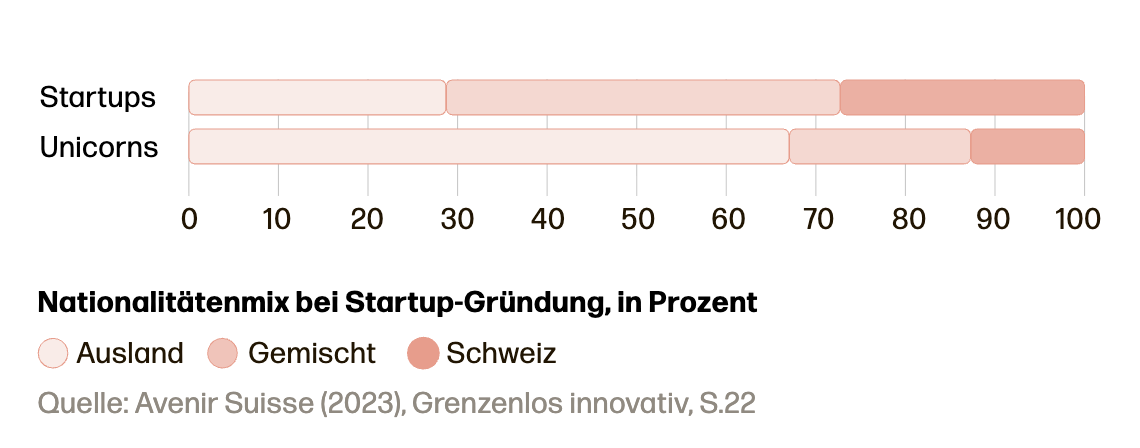

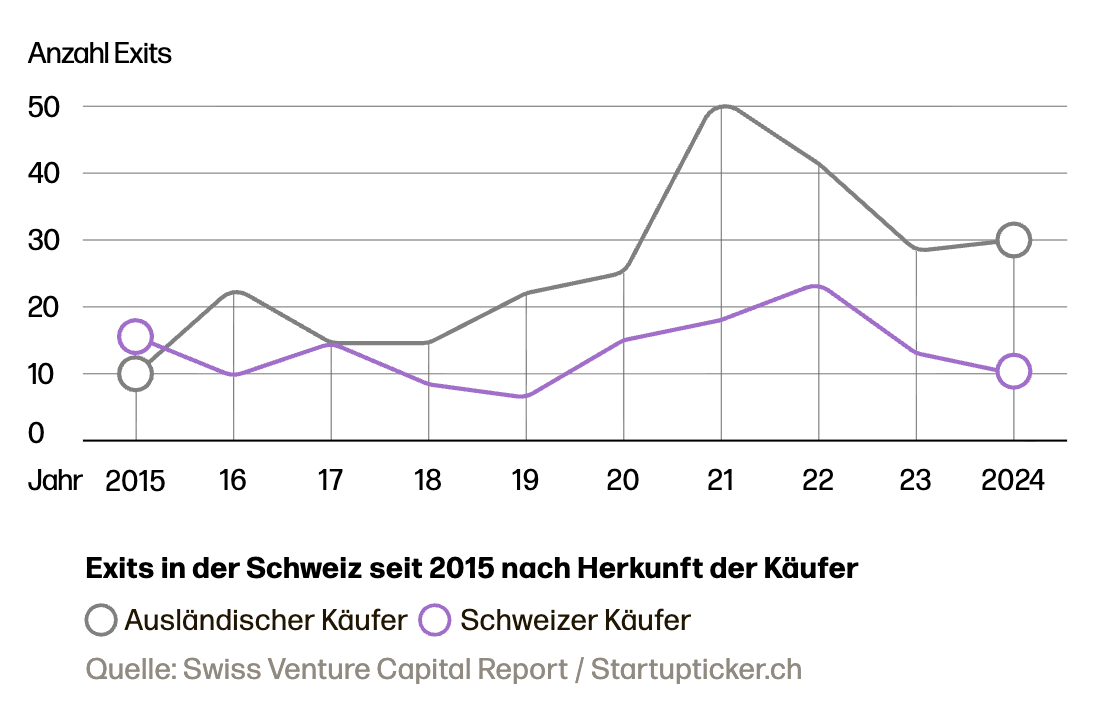

The data tells a concerning story. In 2025, international buyers acquired 31 of 42 Swiss startup exits tracked by Startupticker.ch, with only 10 remaining in Swiss hands. More tellingly, 78% of Switzerland’s unicorns were founded by international teams, yet the country offers no streamlined visa pathway for startup founders from non-EU countries. Companies like On Running, which now employs over 1,000 people in Switzerland from a total workforce of 3,200, and Sensirion, with 900 of 1,200 employees based in Stäfa, demonstrate the job creation potential when startups scale domestically.

The manifesto identifies a pattern: Swiss startups rarely fail due to weak technology or poor talent. They struggle because Switzerland optimizes for company formation but not for scaling. As SSA President Raphael Tobler states in the document’s introduction, “Startups in Switzerland seldom fail due to their ideas, but rather structural hurdles that individually seem small yet collectively slow down the ecosystem.“

Pillar 1: Unlocking Global Talent for Swiss Innovation

The manifesto’s first cluster addresses talent acquisition and retention through seven interconnected reforms. At the top of the priority list sits employee stock option plan (ESOP) standardization, rated important by 81% of surveyed SSA members.

According to the Not Optional initiative’s 2025 European benchmarking study, Switzerland ranks dead last among 25 countries for ESOP friendliness, categorized as “Ripe for Change.” The core problems: complex tax treatment with cantonal variations, potential taxation before employees realize actual financial gains, and the need for costly tax rulings to navigate compliance. For startups competing globally for engineering talent, Switzerland’s ESOP regime represents a material disadvantage against competitors in Berlin, London, or Stockholm.

The reform package proposes uniform grace periods for equity grants to late co-founders, graduated taxation declining to zero capital gains tax after five years, and recognition of purchase prices paid by employees to avoid double taxation. These changes would align Switzerland with international best practices while reducing administrative burdens that currently force startups to engage expensive legal counsel for standard equity compensation.

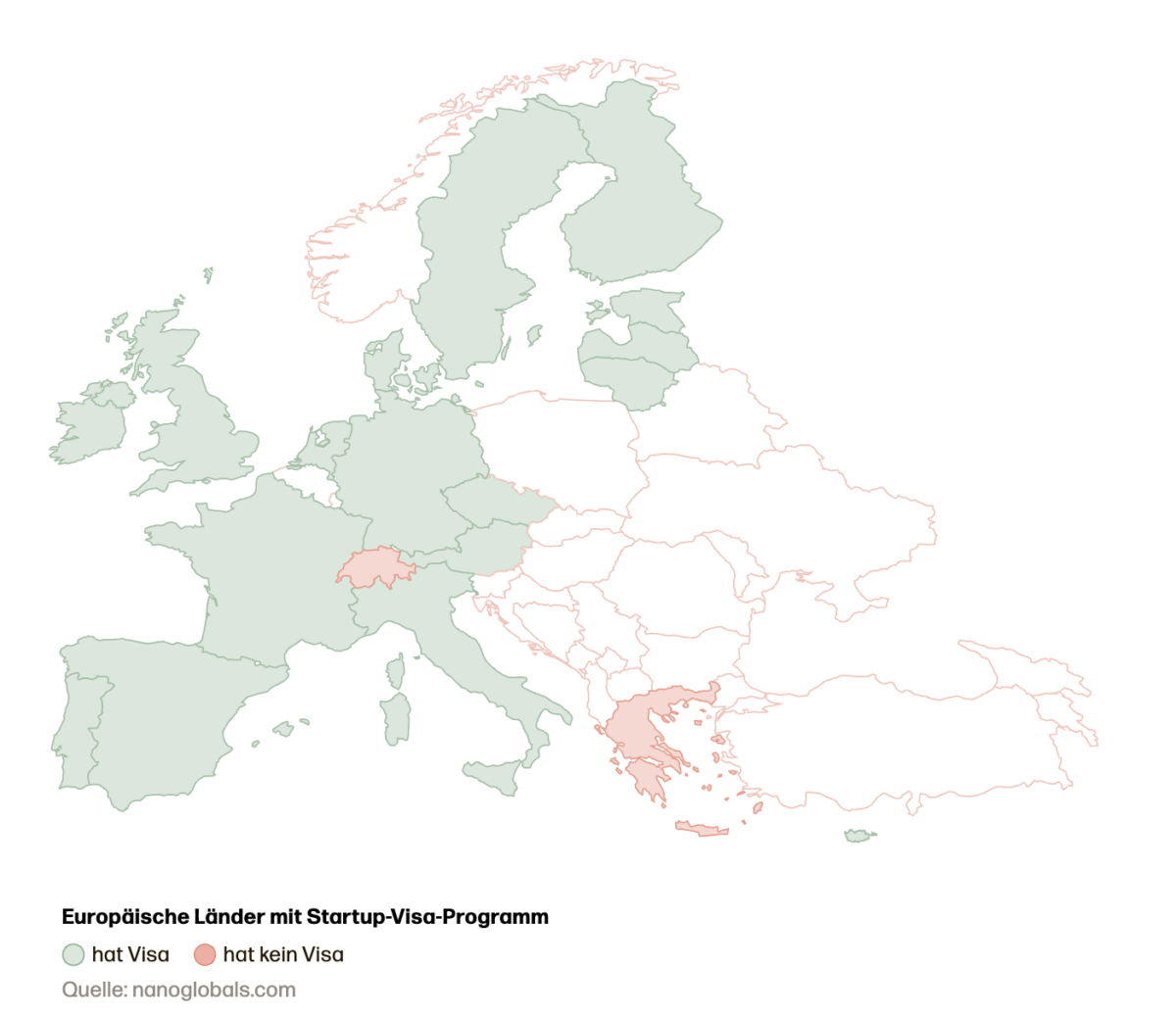

Beyond equity compensation, the agenda demands streamlined work permits for both employees and founders from non-EU countries. Current processing times stretch for months; the manifesto calls for maximum two-week turnaround for qualified applicants through fully digital processes. As Stef van Grieken, Co-Founder and CEO of Cradle, notes in the document: “International founders are essential for startup creation in Switzerland, yet we lack a reliable and practical startup visa. If we want new companies to emerge here and stay long-term, we must actively attract talent to Switzerland rather than unnecessarily complicate their market entry.“

The talent pillar extends into education, calling for mandatory entrepreneurship curriculum in secondary and tertiary education. Switzerland’s universities excel at producing researchers; the ecosystem now needs equal emphasis on developing company builders. As the manifesto observes, countries like the United States and Sweden have long integrated entrepreneurship education, treating it as foundational as mathematics or languages. Switzerland’s current approach leaves such training to individual faculty initiative, creating inconsistent outcomes.

Pillar 2: Mobilizing CHF 1.2 Trillion in Pension Capital

The capital and financing pillar tackles Switzerland’s most significant structural challenge: the growth-stage funding gap. Swiss startups raised CHF 2.95 billion in 2025 according to the Swiss Venture Capital Report, with 85% originating from international investors. While this validates Swiss innovation quality, it creates dependency on foreign capital that often comes with expectations for geographic relocation as companies scale.

“Switzerland doesn’t lose its best startups due to lack of innovation, but due to lack of growth capital. We must do everything possible to ensure Swiss capital seizes the attractive opportunities in the deep tech sector and finances Swiss pioneers.”

Joanne Sieber, CEO Deep Tech Nation Switzerland

This assessment captures the core tension between potential and financial reality. Switzerland possesses approximately CHF 1.2 trillion in pension fund assets, yet these institutions allocate minimal capital to domestic venture funds. The manifesto proposes targeted measures to unlock pension fund investments through improved fund structures, risk-sharing mechanisms via co-investment models, and education initiatives for pension fund decision-makers about venture capital mechanics.

Beyond institutional capital, the manifesto identifies a critical need to activate the domestic private sector. Transactions between established corporations and startups remain surprisingly rare in Switzerland, often due to a cultural and strategic hesitance that sees many promising companies acquired by foreign competitors instead. The agenda proposes bridging this gap through investment tax allowances for corporations that acquire or invest in local startups, alongside digital tools designed to facilitate deeper networking between industry giants and agile innovators. This is matched by a push for robust tax incentives for business angels – similar to those found in the UK and France – to unlock significant private capital flows for early-stage growth. As Angel Investor Thomas Dübendorfer notes, there is currently significant legal uncertainty regarding investment syndicates and the taxation of capital gains upon exit. By clarifying these frameworks and introducing a tax deduction for startup investments, Switzerland can ensure that private risk-takers are incentivized to build the nation’s future job engines rather than sitting on the sidelines.

The manifesto also demands creation of a “growth market regime” equivalent to the EU’s SME Growth Markets framework. Currently, Swiss scale-ups face the same stringent prospectus and disclosure requirements as large-cap companies when considering public listings, making the Swiss stock exchange effectively inaccessible. This regulatory mismatch drives companies toward foreign exchanges; in the past decade, every significant Swiss scale-up either listed abroad or relocated entirely. The proposed reforms would enable SIX Swiss Exchange to create a dedicated growth segment with proportionate requirements, keeping value creation and eventual liquidity events within Switzerland.

Pillar 3: Building a Digital-First Regulatory Environment

The state and regulation pillar addresses the friction costs that accumulate throughout a startup’s lifecycle. Switzerland’s federal structure creates fragmented administrative processes; what works seamlessly in Zug may require different procedures in Geneva or Zurich. The manifesto calls for unified digital platforms enabling complete company formation within days rather than weeks, mirroring systems in Estonia, Singapore, and the Netherlands where entrepreneurs can incorporate online in under 24 hours.

Cost differentials are stark. Forming a company in Switzerland typically costs CHF 2,500 to 5,000 when accounting for notary fees, registration costs, and legal counsel. Comparable European jurisdictions charge EUR 150 to 400. While Switzerland does not need to compete on price alone, reducing barriers to entry would lower the activation energy required for nascent entrepreneurs to test business ideas.

The agenda also targets tax policy through two specific reforms. First, extending corporate loss carryforward from seven to ten years, recognizing that deep tech companies often require extended development periods before profitability. The national council (Nationalrat) has already approved this measure; implementation awaits council of States (Ständerat) action. Second, complete elimination of stamp duty on capital increases and share transactions, which uniquely penalizes equity financing in Switzerland compared to virtually all peer innovation economies.

Finally, the manifesto proposes federal legislation enabling “innovation zones” under Article 64 of the Swiss Constitution, which provides for research and innovation promotion. These designated areas around major research institutions could offer streamlined permitting, facilitated university-startup collaboration, and targeted infrastructure investments. International models like Opportunity Zones demonstrate how geographically focused policy interventions can catalyze ecosystem development without running afoul of equal treatment principles.

Conclusion: From Manifesto to Movement

The “Startup-Agenda Schweiz” represents more than a policy wishlist; it signals ecosystem maturation. When the Swiss Startup Association develops a comprehensive reform agenda with input from 18 organizations spanning corporate VCs (Zühlke Ventures), independent funds (Redalpine, b2venture, Founderful), accelerators (FONGIT, Venturelab), university bodies (ETH Entrepreneurs Club), industry associations (SICTIC, Swiss Healthcare Startups), and media (Startupticker.ch), political capital exists for substantive reform.

Implementation will require coordination across federal and cantonal authorities. Many of the most impactful reforms – work permit processing, digital government services, ESOP taxation – fall partially or entirely under cantonal jurisdiction, necessitating 26-way alignment or federal preemption. Others, like pension fund investment frameworks and securities regulation, sit firmly at the federal level where legislative timelines extend across multiple parliamentary sessions.

Yet the alternative to reform carries greater risk. Switzerland’s deep tech sector produces world-leading research and attracts 60% of Swiss VC funding, the highest share globally (Swiss Deep Tech Report 2025). Robotics companies raised approximately $250 million across 30+ rounds in 2024, cementing Switzerland’s position as Europe’s robotics capital. The technical foundation for continued leadership exists. What the manifesto makes clear is that technical excellence alone cannot sustain Switzerland’s position if the best companies relocate abroad to access growth capital, talent, and exit liquidity.

The path forward is straightforward: implement the reforms that allow Switzerland to retain what it creates. The ecosystem has identified the barriers, built consensus on solutions, and mobilized political support across party lines. Now comes execution.

The “Startup-Agenda Schweiz” will be available in English, French and Italian soon.

Leave a Comment

Your email address will not be published. Required fields are marked *