How Venture Kick’s Three-Stage Model Attracted $12.3 Billion to Swiss University Startups

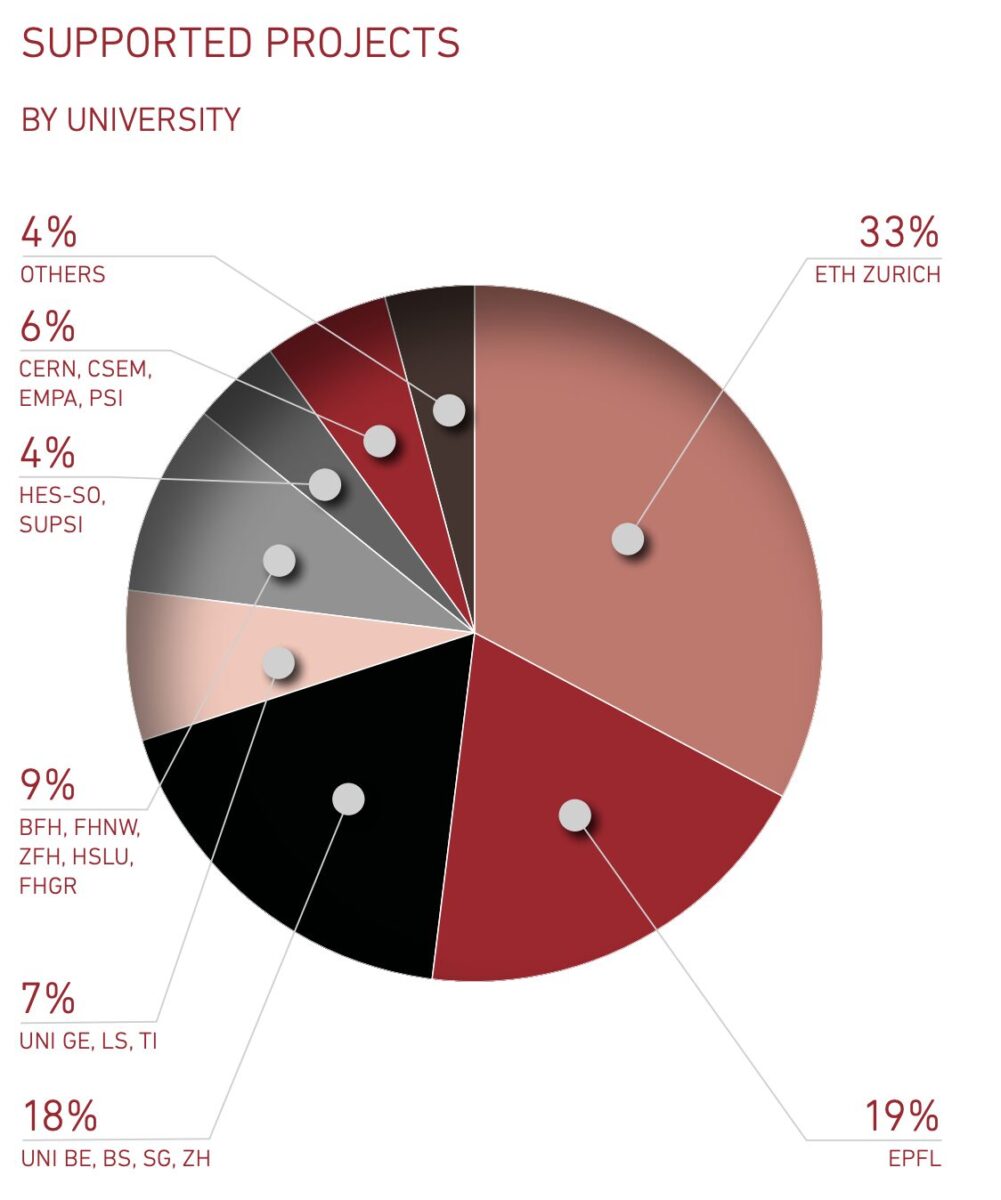

For international investors seeking Switzerland’s most promising early-stage startups, Venture Kick stands as the definitive filter. Since 2007, this philanthropic initiative has converted academic research from ETH Zurich, EPFL, and other Swiss universities into 1,251 commercially viable ventures. The results validate a structured approach: 84% survival rate, $12.4 billion in follow-on investment, and two unicorns.

All Swiss franc amounts in this article are converted to U.S. dollars using the 2025 average exchange rate of CHF 1 = $1.207, providing consistent year-over-year comparisons for international readers.

Venture Kick Impact at a Glance

- 1,251 startup projects supported since inception in 2007

- over $75 million invested directly by Venture Kick

- $12.4 billion raised by alumni companies from follow-on investors

- 84% survival rate for incorporated companies (versus ~50% industry average)

- 16,100 active jobs created across portfolio

- 2 unicorns: Climeworks (climate tech) and Cyberhaven (cybersecurity)

- 66 companies represented in TOP 100 Swiss Startups 2025

A Systematic Pipeline: How the Three-Stage Model Works

Venture Kick operates as a three-stage funding competition designed to progressively validate and strengthen university spinouts. The structure addresses a critical market gap: early-stage startups carry risks too high for traditional venture capital yet require more than academic grants can provide.

Stage 1

The first stage awards $12,070 to projects demonstrating a viable business idea. Teams pitch to expert juries composed of successful entrepreneurs and investors. The funding supports initial customer discovery and business model development. Approximately 50% of presenting teams advance, receiving capital before company incorporation.

Stage 2

The second stage provides $48,280 as a convertible loan to teams that have structured their business case and identified initial customers. Over three months, founders refine their go-to-market strategy with guidance from Kickers Camps, intensive workshops led by experienced entrepreneurs. Again, 50% of stage two participants earn advancement.

Stage 3

The third stage delivers $120,700 to market-ready companies that have demonstrated traction and entrepreneurial capacity. By this point, teams have incorporated and prepared for institutional investment. The final kick positions startups to raise Series A funding.

Beyond the three core stages, successful participants access two additional funding mechanisms. Kickfund offers up to $1.03 million in equity investment to promising graduates. The InnoBooster program, operated by Gebert Rüf Stiftung, provides an additional $181,000 grant for research-intensive projects. Combined, a single startup can secure $1.39 million through the complete Venture Kick ecosystem.

The selection process maintains rigor without being prohibitively exclusive. A jury pool exceeding 250 established entrepreneurs and investors evaluates 20 projects monthly across all stages. This creates a competitive yet achievable pathway; the 50% pass rate at each stage means strong teams face realistic odds rather than lottery-like probabilities.

Beyond Capital: Kickers Camps and Network Access

Financial support represents only one dimension of Venture Kick’s value proposition. The program’s structure around Kickers Camps differentiates it from passive grant mechanisms.

These intensive sessions guide founders through customer development, pitch refinement, and investor relations. Participants learn to structure term sheets, negotiate with strategic partners, and close commercial deals. The curriculum emphasizes execution over theory; successful alumni frequently credit these camps for preventing fatal early-stage mistakes.

Network access proves equally valuable. Venture Kick maintains relationships with 250 international entrepreneurs and investors who serve as mentors, jury members, and potential co-investors. This network extends beyond Switzerland through Venturelab, the organization that operates Venture Kick alongside complementary programs. Many alumni secure initial customers or U.S. market entry through connections built during the program.

Top-performing Venture Kick startups gain access to Venture Leaders, international roadshows to Silicon Valley, Boston, London, Munich, and other global innovation hubs. These Swiss National Startup Teams pitch to leading venture capital firms, meet corporate partners, and build relationships that accelerate international expansion. This progression from early validation through Venture Kick to global market access through Venture Leaders creates a comprehensive support pathway for ambitious founders.

The Track Record Speaks: Notable Alumni Success Stories

The portfolio’s performance demonstrates systematic success rather than isolated wins. Multiple Venture Kick graduates have achieved exceptional outcomes across diverse sectors, positioning Switzerland as a leader in robotics, climate tech, and other deep tech domains.

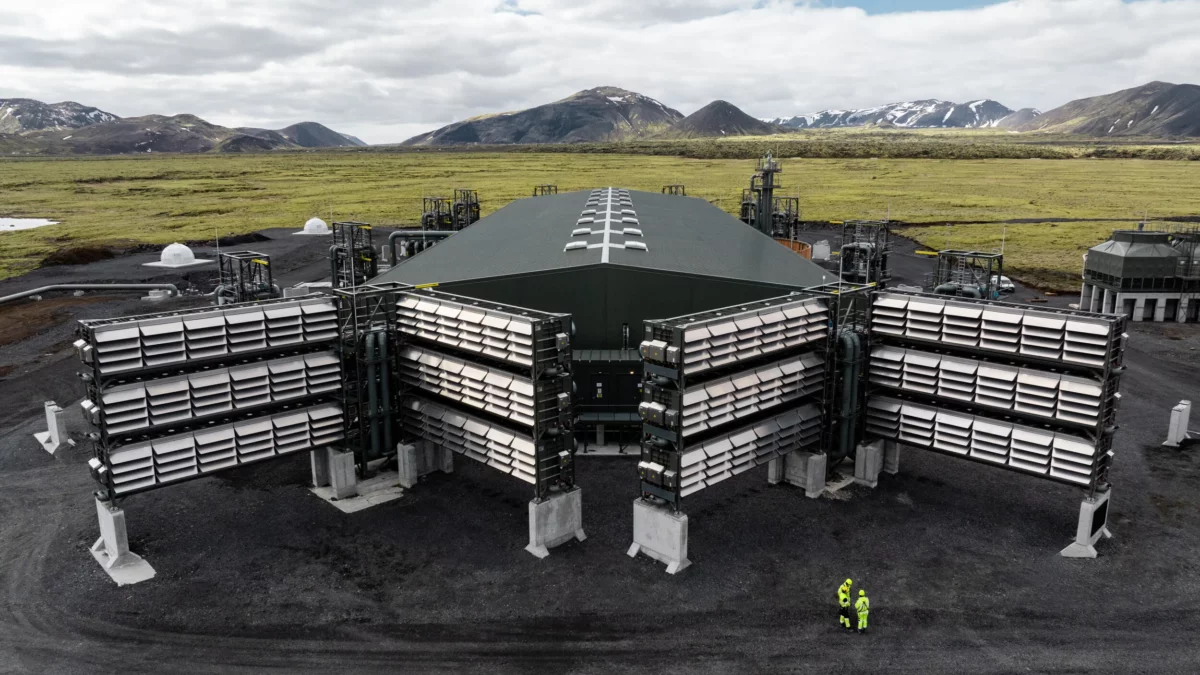

Climeworks

Climeworks, the 2010 Venture Kick final winner, exemplifies the program’s potential ceiling. The ETH Zurich spinout pioneered Direct Air Capture technology and secured more than $1 billion in funding by 2025. Climeworks built the world’s largest operational carbon removal facilities (Orca and Mammoth in Iceland), establishing themselves as the global leader in atmospheric CO2 capture. The company achieved unicorn status and now serves major corporations committed to carbon neutrality.

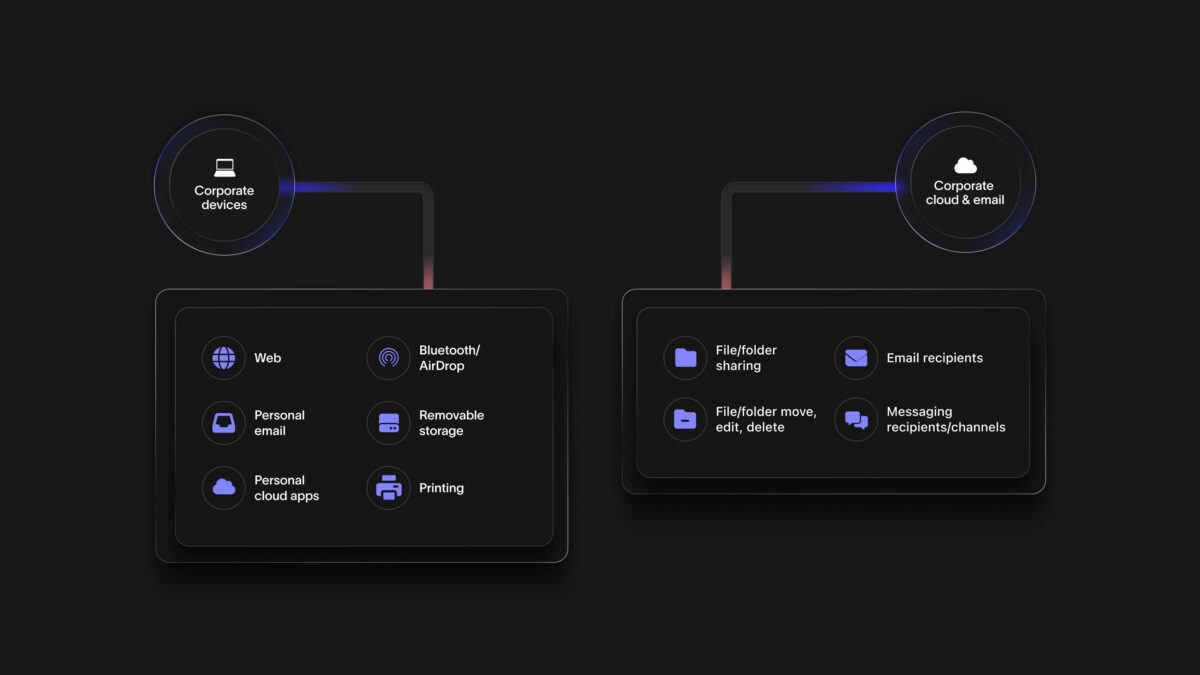

Cyberhaven

Cyberhaven reached unicorn valuation in 2025 with its Data Behavior Analytics platform. The cybersecurity company enables enterprises to track sensitive data across endpoints, servers, and cloud applications in real-time. Its success reflects growing demand for advanced data protection as cyber threats escalate.

Flyability

Flyability, the 2015 Venture Kick winner and EPFL spinout, transformed industrial inspection with collision-proof drones. The company’s Gimball technology allows safe navigation in confined spaces too dangerous for human inspectors. Flyability now serves energy, mining, and infrastructure sectors globally, having raised multiple funding rounds to scale production.

Abionic

Abionic is an ETH Zurich spinout who developed rapid diagnostic technology that delivers lab-quality test results in minutes at the point of care. The company’s abioSCOPE platform enables healthcare providers to diagnose infections and diseases without sending samples to centralized laboratories, transforming emergency care and rural healthcare delivery.

Additional notable alumni include Beekeeper, whose employee communication platform connects frontline workers; MindMaze, applying VR to neuroscience; and Lunaphore, accelerating cancer diagnostics. The portfolio spans climate tech, robotics, biotech, enterprise software, and hardware sectors highlighted in the Swiss Deep Tech Report.

Statistical concentration in the TOP 100 Swiss Startups underscores this quality. In 2025, Venture Kick alumni represented 66 of 100 ranked companies, demonstrating that two-thirds of Switzerland’s most promising startups passed through this single program. Alumni also dominate Swiss startup awards; approximately two-thirds of recipients across major competitions trace back to Venture Kick.

2025: Record Growth and Ambitious Expansion

The program’s recent performance indicates accelerating impact. In 2025, Venture Kick supported 158 startups with $10 million in direct investment, representing 34% growth compared to 2024. These companies collectively attracted $1.51 billion in follow-on financing within the same year, validating the program’s ability to prepare startups for institutional capital.

This growth trajectory aligns with ambitious targets. Venture Kick aims to support 3,000 startups by 2035, creating 100,000 jobs and helping portfolio companies raise $60.4 billion total. Achieving this requires expanding the donor consortium and increasing annual capacity.

For 2026, the program plans to increase supported projects by 15% while maintaining selection standards. This expansion responds to growing deal flow from Swiss universities, which continue producing research with commercial potential across deep tech sectors.

Unlike venture funds constrained by return expectations and deployment timelines, Venture Kick operates on donated capital specifically allocated for high-risk, pre-commercial projects. This structure allows patient capital deployment at stages where failure rates remain high but breakthrough potential exists.

The Swiss Ecosystem Multiplier Effect

Venture Kick functions as infrastructure within Switzerland’s broader innovation system. The program connects multiple ecosystem components that independently support startups.

Universities provide the source: ETH Zurich, EPFL, and other research institutions generate intellectual property and technical talent. Venture Kick identifies promising projects before formal spinout, helping founders structure companies around their research.

The program integrates with complementary initiatives operated by Venturelab, the parent organization. Venture Leaders conducts international roadshows to Silicon Valley, Boston, London, and Munich. Selected companies form the Swiss National Startup Team and gain direct access to top-tier investors and corporate partners. The TOP 100 Swiss Startup Award provides annual recognition and visibility. Innosuisse startup training delivers foundational entrepreneurship education. This ecosystem layering creates multiple support touchpoints without redundancy.

Financial integration amplifies impact. Approximately 30% of all venture capital invested in Switzerland flows to Venture Kick alumni. Major Swiss and international VCs recognize Venture Kick graduation as positive signal quality.

The private consortium model deserves emphasis. Rather than relying on government budgets subject to political cycles, Venture Kick draws support from foundations and private donors committed long-term to Swiss innovation. This independence allows rapid decision-making and program evolution based on startup needs rather than bureaucratic requirements.

Switzerland’s Pre-Seed Infrastructure Advantage

Venture Kick’s performance over 19 years establishes a model for systematic university spinout success. The combination of staged funding, hands-on support, and network access creates conditions where academic research can become commercially viable at scale. An 84% survival rate and $12.3 billion in follow-on investment demonstrate that this approach works consistently, not occasionally.

For international investors and ecosystem actors, Venture Kick alumni represent a curated dealflow of Swiss deep tech startups. The program’s rigorous selection across three stages filters thousands of ideas down to companies that have validated business models, identified customers, and demonstrated execution capacity. Two unicorns and 66 companies in the latest TOP 100 ranking indicate the portfolio’s quality.

Switzerland’s position as Europe’s leading deep tech nation derives partly from infrastructure like Venture Kick. The program converts academic excellence into economic impact, filling the pre-seed funding gap that constrains many innovation ecosystems. As the initiative scales toward its 2035 goals, it will shape Switzerland’s next generation of globally competitive technology companies.

FAQ on Venture Kick

What is Venture Kick and how does it work?

Venture Kick is a philanthropic three-stage funding program for Swiss university spinouts. Teams pitch to expert juries at each stage, with 50% advancing. Winners receive $12,070 (Stage 1), $48,280 (Stage 2), and $120,700 (Stage 3), plus access to Kickers Camps for business development training and a network of 250+ international investors and entrepreneurs.

How much total funding can a startup receive through Venture Kick’s ecosystem?

A startup can receive up to $1.39 million through the complete ecosystem: $181,000 from the three core stages, $1.03 million equity investment from Kickfund, and $181,000 from the InnoBooster grant program. The three-stage funding is provided before or at company incorporation, while Kickfund and InnoBooster support later development.

What is the success rate for companies that complete Venture Kick?

Venture Kick alumni achieve an 84% survival rate for incorporated companies, significantly exceeding the roughly 50% industry average for early-stage startups. Alumni have collectively raised $12.3 billion in follow-on investment and created 16,100 jobs. Approximately 66% of TOP 100 Swiss Startups in 2024 were Venture Kick alumni, and the portfolio includes two unicorns.

Can international researchers at Swiss universities apply to Venture Kick?

Yes. Venture Kick supports startup projects originating from Swiss universities and research institutions, regardless of founder nationality. The program focuses on the quality of the business idea and its connection to Swiss academic research. Many successful alumni teams include international founders who conducted research at ETH Zurich, EPFL, or other Swiss universities.

How does Venture Kick differ from traditional accelerators?

Unlike equity-taking accelerators, Venture Kick provides non-dilutive grants at stages 1 and 2, with convertible loans at stage 3. The program runs continuously rather than in cohorts, allowing teams to apply year-round. Support spans nine months across three distinct validation stages. Venture Kick focuses exclusively on Swiss university spinouts in deep tech sectors rather than general startup populations.

What role does Venture Leaders play in supporting Swiss university startups?

Venture Leaders, operated by Venturelab alongside Venture Kick, organizes international roadshows that bring Swiss startups to key markets worldwide. Selected companies (forming the Swiss National Startup Team) gain direct access to investors, customers, and partners in regions like Silicon Valley, Boston, London, Munich, and other innovation hubs. Many Venture Kick alumni participate in Venture Leaders to accelerate international expansion across verticals including technology, biotech, medtech, fintech, and cleantech.

Leave a Comment

Your email address will not be published. Required fields are marked *